WE KNOW MEDICARE!

WE KNOW MEDICARE!

What Is Medicare?

Medicare is a Federal program that you have contributed to your whole life through taxes. When of age, or under other circumstances, you will qualify to enroll into Medicare so you have health coverage in

Medicare Part A - Hospital Insurance

Medicare Part A, also known as hospital insurance, is a fundamental component of the Medicare program designed to cover essential inpatient healthcare services. This includes hospital stays, care provided in a skilled nursing facility, hospice care for individuals with terminal illnesses, and certain home health care services. Most individuals qualify for Part A without a monthly premium if they or their spouse have worked and paid Medicare taxes for at least ten years. For those who do not automatically qualify, coverage can still be obtained by paying a monthly premium. Medicare Part A forms the foundation of Medicare coverage, providing critical support for individuals needing hospital or specialized facility care. It’s an essential resource for older adults and those with qualifying conditions, ensuring access to high-quality inpatient care without the burden of excessive out-of-pocket costs.

A

B

Medicare Part B – Medical Insurance

Medicare Part B plays a vital role in covering outpatient medical services and preventive care. It includes doctor visits, diagnostic tests, outpatient procedures, and services like physical therapy and mental health care. Additionally, Part B covers preventive services, such as flu shots, cancer screenings, and wellness visits, aimed at helping you stay healthy and catch potential issues early. Unlike Part A, Medicare Part B requires a monthly premium, which is determined based on your income level. There is also an annual deductible and coinsurance for some services. Together with Part A, Part B forms what is known as Original Medicare, providing a comprehensive safety net for most routine and specialized medical needs. This coverage ensures that beneficiaries have access to outpatient care and preventive resources critical for maintaining their overall well-being.

Medicare Part C – Medicare Advantage

Medicare Part C, commonly known as Medicare Advantage, is an all-in-one alternative to Original Medicare provided by private insurance companies approved by Medicare. These plans bundle the benefits of Medicare Parts A and B, often including additional perks such as dental, vision, hearing, and wellness programs. Many Medicare Advantage plans also incorporate prescription drug coverage, combining the convenience of comprehensive care into a single plan. One of the standout benefits of Medicare Advantage is the potential for lower out-of-pocket costs, though plans may have specific networks of doctors and healthcare providers. Medicare Advantage plans can vary significantly in terms of premiums, coverage options, and additional benefits, making it essential to explore and compare plans to find one that aligns with your specific health and financial needs. With its customizable options, Part C offers a modern, flexible approach to healthcare coverage.

C

D

Medicare Part D – Prescription Drug Coverage

Medicare Part D focuses exclusively on helping beneficiaries manage the cost of prescription medications. Offered through private insurers, Part D plans can be added to Original Medicare or certain Medicare Advantage plans. Coverage and costs vary across plans, with each having its own list of covered drugs (formulary). Beneficiaries typically pay a monthly premium, an annual deductible, and a copayment or coinsurance for medications. Part D plans are invaluable for seniors and individuals managing chronic conditions, as they significantly reduce the financial burden of prescription drugs. It is important to review Part D plans annually during Medicare's open enrollment period, as formularies and costs can change from year to year. This ensures that your plan continues to meet your healthcare needs efficiently and affordably.

Does this sound like your situation?

I am already retired, and I'm turning 65 in the coming months and I'm not 100% sure I know what I need to do. Can you help guide me?

I am turning 65 in the coming months, but plan on working still, and I have work benefits. I'm not sure I need to take Medicare, but people have been telling me about penalties. What do I do?

I am older than 65 years old, I postponed my Medicare since I had group insurance while working, and I'm retiring soon and need to start my Medicare. What do I do?

I am UNDER 65, and just got on disability(SSDI) through social security and was told I would be getting Medicare as a result. I need to know what my next steps are!

I currently have a Medicare Supplement(Medigap) plan and I heard about Idaho's Birthday Rule that will allow me to change supplements. I need more information!

I am a retired Veteran and use the VA for everything, but I want access to all the benefits of Medicare also. Can you help educate me on what I have access to?

I'm in a unique situation, and I just need someone who knows what they heck they are talking about to help me!

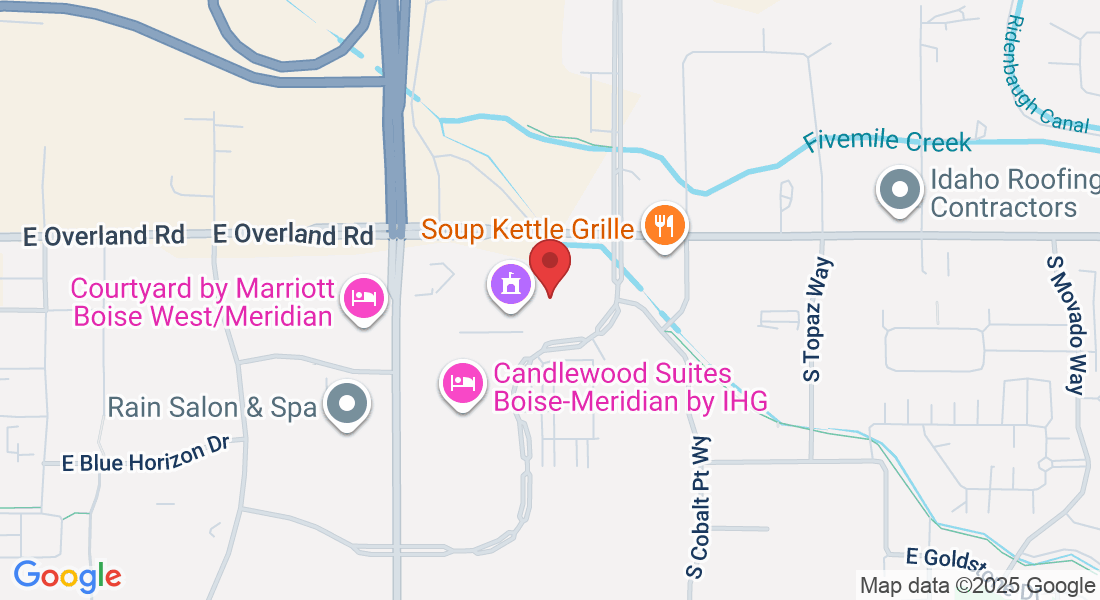

If any of these situations sounds like yours, please get in touch with us! Our services to you are 100% free to you. We love education as our primary method of helping people and you won't get a sales pitch from us. We just want to leave you better than we found you! We can't wait to talk with you!

Who do we represent?

Home | About us | Contact us | Medicare | Individual Insurance | Group Benefits | Vision/Dental | Life Insurance

Copyrights 2025 | Longwill Insurance | Terms & Conditions | Privacy Policy